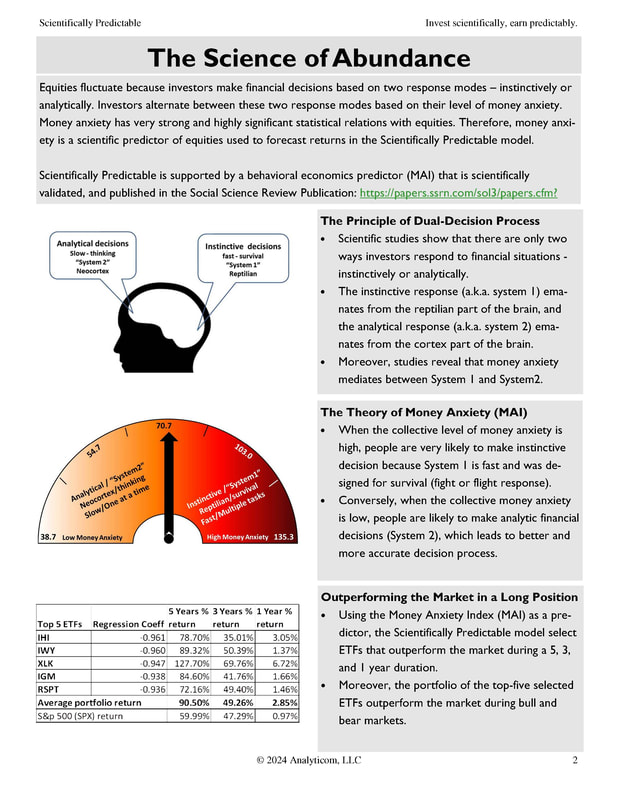

Follow Science to Create Abundance

Following the Scientifically Predictable investing model is shown to produce an average long-term annual return of 20%; twice as much as the 10% produced by the S&P 500.

|

What is Scientifically Predictable

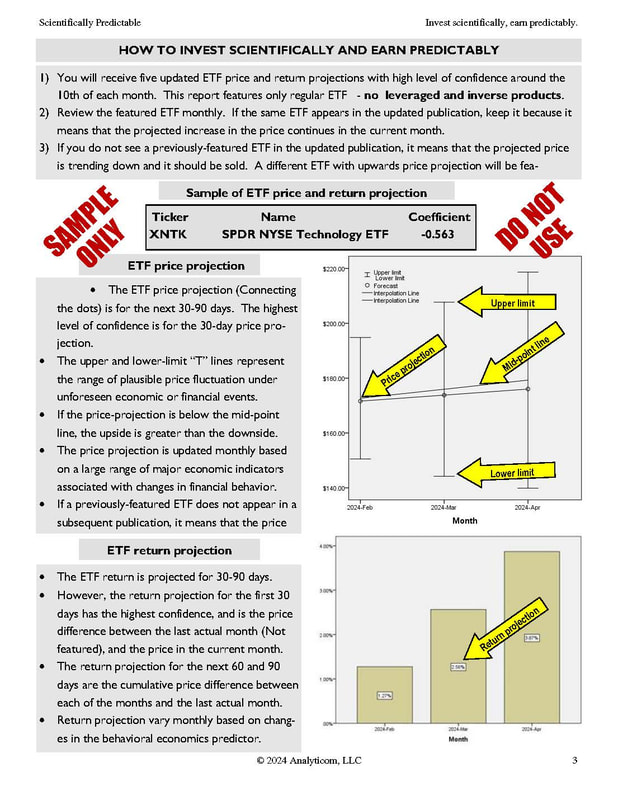

Scientifically Predictable is a self-directed (do-it-yourself) investment model. You manage your own money, and you keep your existing IRA or investment account. You simply follow the scientific projection provided by the model monthly. Scientifically Predictable is based on validated and published scientific study showing a long-term average return of 20% per year. Scientifically Predictable allows you to double your invested money in half the time. An IRA account linked to the S&P 500 index will return a long-term average of 10%, which will take 7.2 years to double your money. Scientifically Predictable shows a long-term average return of 20%, which will double your money in half the time – 3.6 years. Scientifically Predictable is a published scientific projection that is exempt from advisory registration based on SEC's publisher's exclusion Section 202(a)(11)(D). Therefore, no investment advice is available. How to use Scientifically Predictable When you subscribe to Scientifically Predictable, you will receive a monthly update featuring five ETFs. Every month, during your subscription, the model will include updates to the Fop Five ETFs. If any of the ETFs is projected to decline, it will be dropped and a new ETF will be provided. Thus, you can have peace of mind knowing that your portfolio is going to outperform the market with extremely high level of confidence. Scientifically Predictable is ready to use right away. You do not need any software or special equipment to use it. Moreover, you do not need prior experience in investing or specialized knowledge to use Scientifically Predictable, and you may use any trading platform to invest. The subscription costs $180 per month. Start or end your subscription at any time without prior notice. Subscribing is easy, just click on the subscribe now button below, and you are on your way to outperform the market scientifically and predictably |