Double your money in half the time!

|

It takes 7.2 years to double your money in the market’s benchmark – the S&P500 index, based on a historical return of 10% a year. But now, you can double your invested money in half the time – 3.6 yeas, by using the Scientifically Predictable self-investing program, which you can obtain from your financial institution (Bank or credit union), or your organization (Union, charitable organization and alike). Just ask them to request a top-executive demo by going to the bottom of this page.

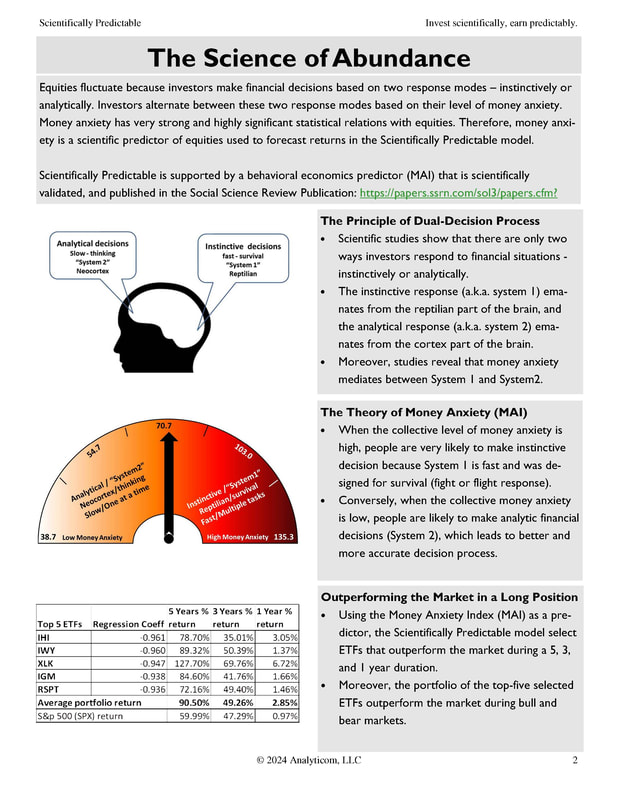

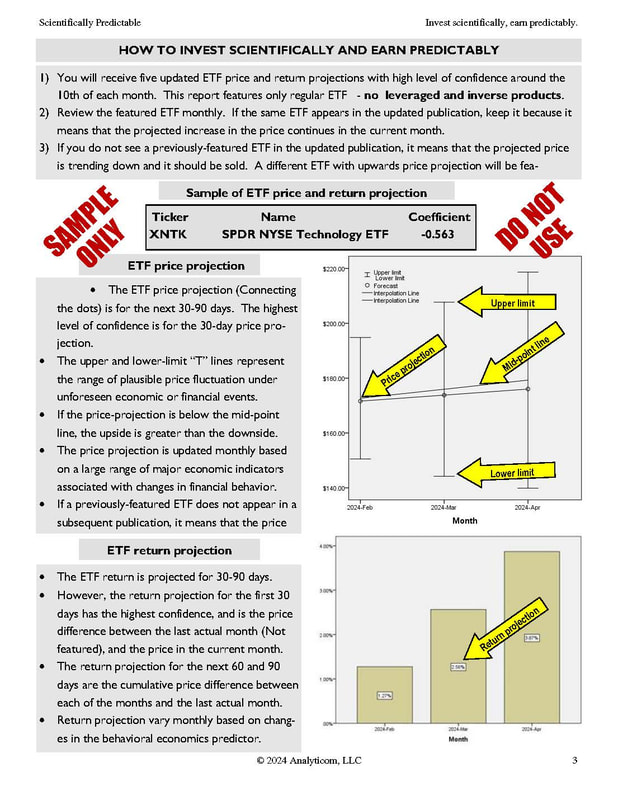

Scientifically Predictable is a self-investing program that is based on a validated and published scientific study: “Money Anxiety Theory - a Predictor of Equity’s Performance.” The study shows that by simply following the five-recommended ETFs, self-investing customers or members can outperform the market with an extremely elevated level of confidence. Additionally, the study shows that the ability to outperform the market occurs during bear or bull market alike, which makes it extremely attractive to customers and members. The program is extremely easy to implement and use. The institution or organization emails the monthly projection to their customers or members, who simply invest in the five ETFs featured in the monthly projection. If there is a change in the projected ETF’s, the following monthly projection will reflect that. The self-investors may use any investment platform they wish without paying any advising fees or product commission. |

Scientifically Predictable returned 29.7% with an alpha of 6.4% in FY 2024

Key Features:

- The Scientifically Predictable investing projection is validated by a scientific paper: “Money Anxiety Theory - a Predictor of Equity’s Performance” published in SSRN.

- The study shows that the Scientifically Predictable model outperforms the market with extremely high level in confidence and during bull and bear markets.

- Scientifically Predictable offers minimal risk investing with high level of confidence.

- There are no advisory fees, trading fees or broker/dealer commissions.

- Scientifically Predictable is a published scientific projection that is exempt from advisory registration based on SEC's publisher's exclusion Section 202(a)(11)(D)

- The investing portfolio includes the top five ETFs that are projected to increase.

- Prevents instinctive and emotional investment decisions, which are mostly wrong.

- The Top Five ETFs’ projection is updated monthly around the 10th of the month.

- Higher returns are achieved with long-term investment such as retirement and alike.